Personal debt to equity ratio calculator

You can use a home improvement loan calculator. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

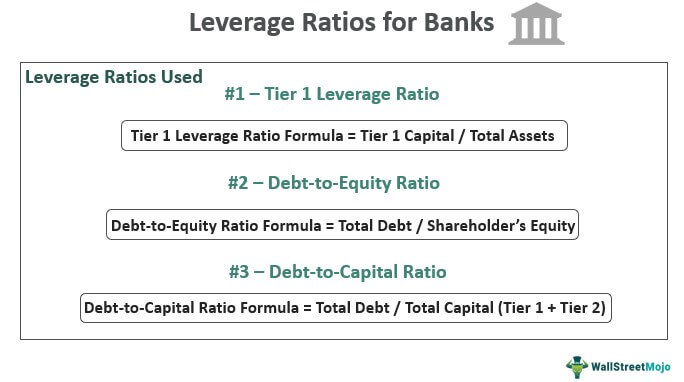

Leverage Ratios Formula Step By Step Calculation With Examples

Lenders will check your credit score income debt-to-income DTI ratio and maximum loan-to-value LTV ratio.

. Established in 1971 and with a presence in 15 states Regions offers a full lineup of personal banking services including checking and savings accounts credit cards mortgages student. That includes debts such as credit cards auto loans mortgages home equity. Mortgage loan basics Basic concepts and legal regulation.

Maximum debt-to-income ratio. In the previous example the company with the 50 debt to equity ratio is less risky than the firm with the 125 debt to equity ratio since debt is a riskier form of financing than equity. Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially.

According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan. Is the ratio of a businesss net profit or income to shareholders equity. A debt-to-income ratio is the percentage of gross monthly income that goes toward paying debts and is used by lenders to measure your ability to manage monthly payments and repay the money borrowed.

As a measure of financial performance it lets you see how well managements investments are performing relative to. Home equity loans have more stringent requirements than mortgages. You can also roughly work out your equity using this calculator.

If your debt-to-income ratio falls within this range avoid incurring more debt to maintain a good ratio. A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination. You may have trouble getting approved for a mortgage with a ratio above.

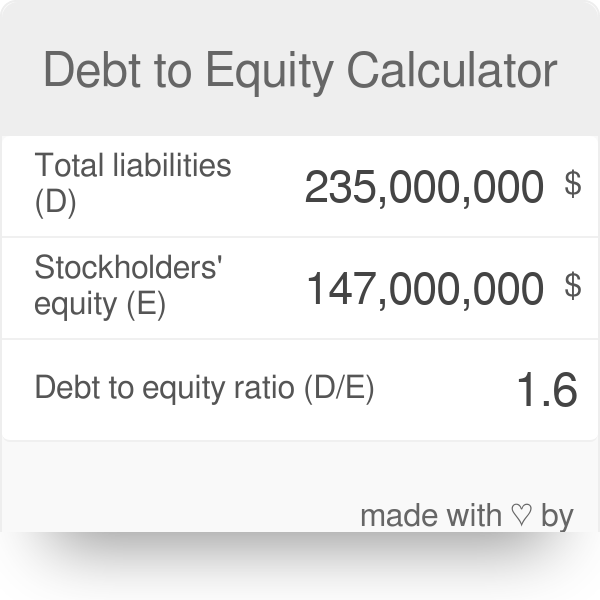

Let Bankrate a leader. The calculator does the math for you and gives you a rough idea of whether the full application is worth the effort. Use this Debt to Equity Ratio Calculator to calculate the companys debt-to-equity ratio.

36 or less is the healthiest debt load for the majority of people. If you are able to afford only a fixed amount every month to pay off debt taking out a. On this page is a Return on Equity or ROE calculator.

Along with being a part of the financial leverage ratios the debt to equity ratio is also a part of the group of ratios called gearing ratios. Enter a companys net income and shareholders equity and the tool will return the realized ROE. 40 or 65 including a mortgage.

If youre a homeowner with strong credit and financial discipline tapping your home equity could be a good debt consolidation option for you. Lenders typically prefer your DTI to be less than 43 though some will allow. Bankrates experts compare hundreds of top credit cards and credit card offers to select the best in cash back rewards travel business 0 APR balance transfer and more.

Even if youre prepared to take the leap you may struggle to find a lender willing to work with your high DTI. For commercial lenders the debt service coverage ratio or DSCR is the single-most significant element to take into consideration when analyzing the level of risk. Simply complete the fields in the form below and click Calculate button.

So for example if the market price of your property is 850000 and your outstanding loan balance is 500000 you have up to 350000 of equity. Debt Evaluation Calculator Current Expense Calculator. Tap your home equity.

Use this calculator to compute your personal debt-to-income ratio a figure as important as your credit score which provides a snapshot of your overall financial health. Interest rates for home equity loans are significantly lower than rates on many other types of debt. Borrower average is 40.

DTI ratio affects how much of your home equity you can access. A debt-to-income ratio DTI is a personal finance measure that compares the amount of debt you have to your overall income. There are two kinds of DTI ratios front-end and back-end which are typically shown as a percentage like 3643.

In addition to loan-to-value and combined loan-to-value ratios lenders will consider your DTI when you apply for a home equity loan or line of credit. Once you know your homes value and your current mortgage balance try a home equity loan calculator to start your home equity loan search. Second mortgages come in two main forms home equity loans and home equity lines of credit.

Get 247 customer support help when you place a homework help service order with us. For example home equity loan rates ranged from 51 percent to 589 percent in 2020 while HELOC rates. What is a debt-to-income ratio.

This is also known as usable equity as it is the amount you can potentially access. Your final result will fall into one of these categories. Second mortgage types Lump sum.

Home equity loans usually. Trim debt-equity ratio to 2. Try a home equity loan calculator before you apply.

Lenders including issuers of mortgages use it as a way to measure. Home equity loan rates can vary depending on the lender and home equity product you choose. What is the debt-to-income ratio to qualify for a home equity loan.

What Your Debt to Income Ratio Means. Home equity loans work similarly to personal loans. Your debt-to-income ratio DTI indicates the percentage of your monthly income that is committed to paying off debt.

Personal Finance EPF Guide MC Minis Big Shark Portfolios. As you consider buying a home its important to get familiar with your debt-to-income ratio DTIIf you already have a high amount of debt compared to your income then moving forward with a home purchase could be risky. Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but.

Our DSCR calculator enables you to calculate your companys debt service coverage ratio DSCR with ease.

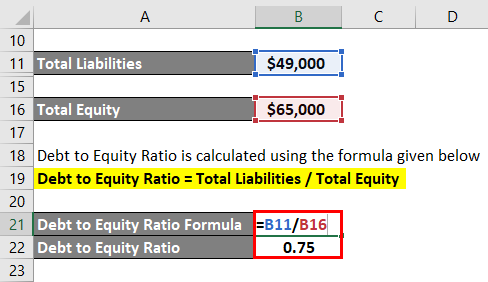

Debt To Equity Ratio Calculator

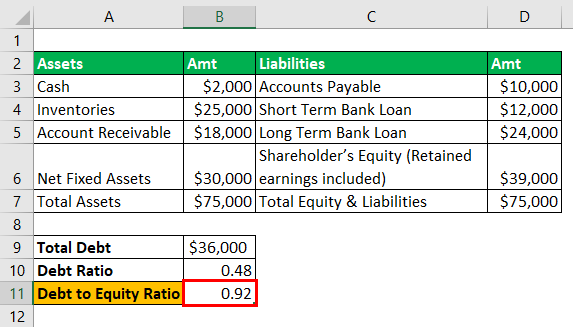

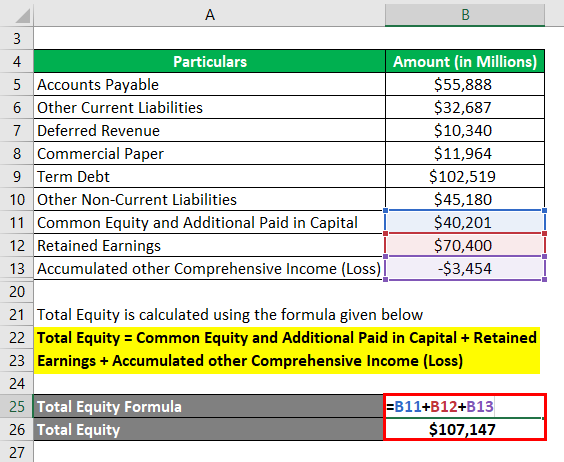

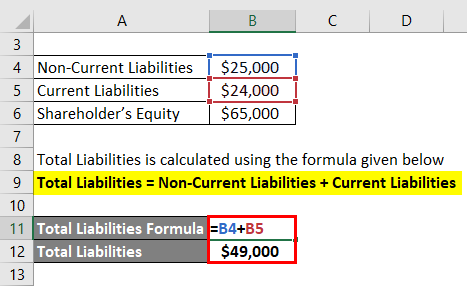

Debt To Equity Ratio D E Formula And Calculator Excel Template

How Do You Calculate The Debt To Equity Ratio

Debt To Equity Ratio Formula Calculator Examples With Excel Template

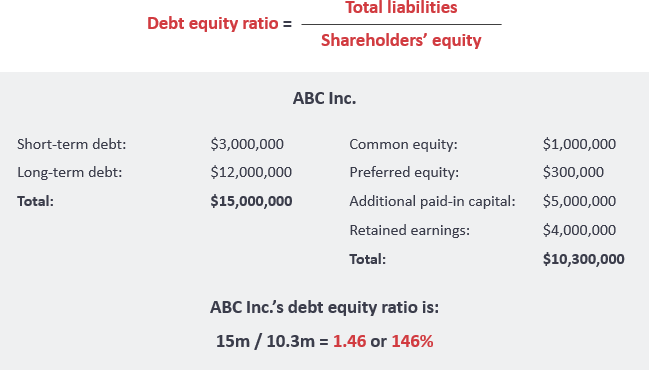

Debt To Equity Ratio Definition Formula Example

How Do You Calculate The Debt To Equity Ratio

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Debt To Equity Ratio D E Formula And Calculator Excel Template

:max_bytes(150000):strip_icc()/debtequityratio.asp_FINAL-0ac0c0d22215418a992fa7facd2354e6.png)

Debt To Equity D E Ratio Formula And How To Interpret It

Debt To Equity Ratio Calculator Formula

Leverage Ratios For Banks Definition 3 Major Leverage Ratios For Banks

Debt To Equity Ratio Definition Formula Example

:max_bytes(150000):strip_icc():gifv()/debtequityratio_final-18c02abef4f74c1591dc9b12be962b1b.jpg)

Debt To Equity D E Ratio Formula And How To Interpret It

J62u1iuzxz5cfm

Debt To Equity Ratio Formula Calculator Examples With Excel Template

How Do You Calculate The Debt To Equity Ratio

Debt To Equity Ratio Formula Calculator Examples With Excel Template